Are Kiwi SMEs seeing first signs of economic slowdown?

- 10 September, 2015 03:10

More than half of New Zealand’s Small-Medium Enterprise (SME) operators are expecting the economy to slow over the coming year, but their current performance and forecasts for the coming year suggest they’ll avoid anything more serious.

According the latest MYOB Business Monitor survey of over 1000 businesses nationwide, over the next 12 months, 34 percent of SME operators expect their business revenue to increase, down from 40 percent in the February survey.

In addition, a further 41 percent are forecasting stable revenue with the number of businesses expecting revenue to drop over the next 12 months in the nationwide survey conducted for MYOB by Colmar Brunton, almost doubling from 11 percent in February to 21 percent.

MYOB New Zealand General Manager James Scollay says while both global and local economic factors are weighing on local SME operators, they are not hitting the panic button.

“Our local SME operators are clearly seeing some downside risk for 2016,” Scollay says.

“But the key point to make is their performance expectations are not falling off the cliff.

“We are seeing a considerable rise in the number of businesses who expect their own growth to come off current levels, but more than a third of SMEs still expect to grow in 2016.”

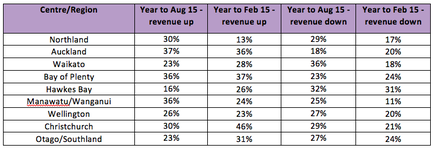

Scollay says that growth levels for SMEs have remained consistent over the last six months, with 31 percent reporting improved revenue in the year to August, compared to 32 percent in February, while 41 percent have maintained stable revenue (44 percent in February).

Pipeline work booked for the next three months has shown a similar pattern, with 31 percent saying they have more work currently on the books, down from 37 percent in February.

Scollay adds that almost a quarter (22 percent) have less work on, a jump from 13 percent in the earlier Business Monitor survey.

Decline expected in overall economy

Over half (51 percent) of all SME operators expect the economy to decline in the next year, 12 percent of them significantly, while just 21 percent expect to see it improve.

Fewer business operators in the major centres expect the economy to decline, including 41 percent of SME operators in Auckland and 40 percent in Wellington, than across the rest of New Zealand, where 58 percent are forecasting deteriorating economic conditions.

Scollay says that the notable exception is Christchurch, where 57 percent of SME operators say New Zealand’s economy will decline in the next year.

A tale of two cities

“One of the notable areas in the research is the changing growth pattern in Christchurch, where the proportion of businesses reporting revenue growth has fallen 16 percentage points since our last survey, to be nearly equal with those seeing revenue fall,” Scollay adds.

“This highlights the difference in the effect of the city’s rebuild now it has reached its predicted plateau.

“However, after coming off previously unseen highs in activity, businesses in the city remain confident of growth, with 38 percent forecasting their revenue will improve in 2016.

“Also encouraging is the steady level of growth we are seeing in Auckland, which remains the driver of the economy with 37 per cent of businesses in the city reporting improved revenue over the last year.

“And while we can clearly see some regions are already feeling the effect of the slowdown in the dairy industry, other rural areas like Northland, Bay of Plenty and the Manuwatu/Wanganui region are holding up well.”

Page Break

Key industries

SMEs in key sectors have maintained growth this year, led by the retail and hospitality sector, in which 39 per cent of operators are reporting revenue growth, up from 36 percent in February.

Scollay adds that also improving are the business, professional and property sector, (37 percent increased revenue, up from 36 percent) and the finance and insurance industry (36 percent up from 20 percent).

Although seeing an improvement in the number of businesses reporting increased revenue - now up to 33 percent from 28 percent in February - the manufacturing industry is more finely balanced, with a third reporting revenue falls in the year to August.

The construction and trades sector has fallen somewhat, down to 30 percent of operators reporting growth, from 35 percent earlier in the first quarter.

Hiring intentions, pay improve

Underscoring the level of confidence still remaining in the SME sector, hiring intentions have lifted slightly.

Scollay adds that nine percent of businesses say they plan to take on more full time staff in the next year, rising from 7 percent in February.

In addition, eleven percent will hire more part time employees, and 20 percent plan to put more in their employee’s pay packets in the year to August 2016.

Possibly shifting the dial on inflation, Scollay predicts that a quarter of SMEs plan to put prices up in the next year.

Market more competitive

In a sign of the growing competition for the consumer dollar, attracting new customers (23 percent) and competitive activity (22 percent) are picked to be the key pressures businesses will face over the next 12 months.

Cashflow, price margins and the cost of fuel are all equal on 20 percent.

“What’s clear from this latest survey is that New Zealand’s SMEs are starting to feel the effects of an economy that is coming off its peak,” Scollay adds.

“However, despite seeing very real examples of the international headwinds we face over the next 12 months - including falling commodities prices, stock market turmoil and uncertain growth in China - the large majority are still forecasting either growing or stable revenue into 2016.

“SMEs seem to be reinforcing prudence over panic - being aware of the challenges to attract customers in an increasingly competitive market, while maintaining investment in retaining customers, improving their IT systems and processes, and managing their margins.

“New Zealand’s SME community has built up an incredible resilience over the past seven years. They are well run, versatile and committed - and I believe that is the best possible preparation for any changes in the economy.”